By Jason Snell

November 2, 2017 5:42 PM PT

Last updated July 30, 2020

Apple results: All systems go for a record holiday quarter

Note: This story has not been updated since 2020.

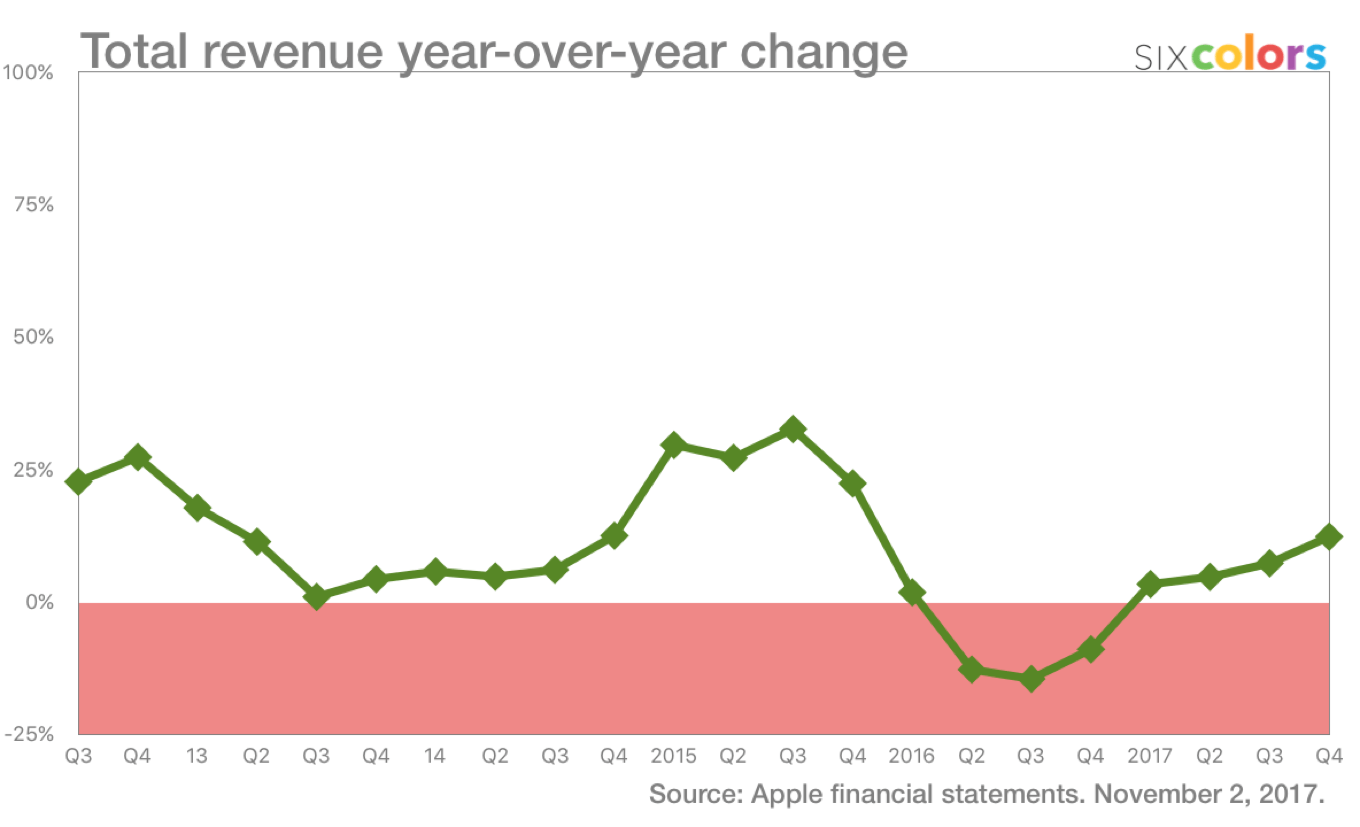

Apple closed out its 2017 fiscal year in style Thursday, and is prepared to barrel into the holiday quarter with huge momentum. For the quarter ending September 30, Apple set a record for its fourth fiscal quarter with $52.6 billion in revenue. Pretty much every product category you can think of showed positive signs, and the news for the next quarter is even better: Apple’s guidance for the first fiscal quarter of 2018 suggests that the traditionally conservative company is going to have its best single quarter ever, and by a wide margin.

I’ll break down some of the most interesting details below, but be sure to check out our complete transcript of the Apple call with analysts.

iPhone 8: Pleasant surprises

This quarter the iPhone was the largest piece of Apple’s pie chart, as always: 55 percent of Apple’s quarterly revenue came from the iPhone. What’s interesting is that Apple CEO Tim Cook characterized the iPhone 8’s sales as having exceeded their expectations.

Cook and CFO Luca Maestri seemed to take direct aim—without mentioning it by name—at a report by KeyBanc Capital Markets analyst John Vinh that the iPhone 7/Plus was outselling the iPhone 8/Plus. Both executives repeatedly mentioned that the moment the 8 and 8 Plus went on sale, “They instantly became our two most popular iPhone models and have been every week since then.” (Vinh wasn’t a participant on the call, shockingly.)

Apple steers away from giving away too much detail of the mix of different iPhone models it sells—on Thursday analysts tried repeatedly to get Cook to talk about it. “Obviously, I’m not going to talk about mix, it’s not something that we’ve done in the past,” he said at one point. But he did offer this tidbit: the iPhone 8 Plus is selling the best of any iPhone Plus model to date.

“That, for us, was a bit of a surprise, and a positive surprise, obviously,” Cook said. “And so we’ll see what happens next.”

iPhone X: It’s all guesswork

Analysts really wanted to know what Apple thinks about iPhone X sales, but as Cook reminded them, this is unexplored territory. So the company has made its best guess, but it doesn’t really know.

“This is the first time we’ve ever been in the position that we’ve had three new iPhones at once like this, at the top end of the line, and it’s the first time we’ve had a staggered launch,” Cook said, and actually chuckled. “And so we’re going to see what happens! But we put our absolutely best thinking that we have here in the guidance… you can tell from that that we’re bullish.”

In terms of speculation that Apple hasn’t been able to make enough iPhone X models to fulfill demand, Cook similarly had little to say. “The ramp for iPhone X is going well, especially considering that iPhone X is the most advanced iPhone we’ve ever created, and it has lots of new technologies in it,” he said.

“And so we’re really happy that we’re able to increase week by week what we’re outputting and we’re going to get as many of them as possible to the customers as soon as possible.”

When challenged by UBS analyst Steve Milanovich about the $999 and up price tag of the iPhone X, Cook pushed back on two different fronts. One of his statements, about pricing strategies, was a bit puzzling: “In terms of the way we price, we price to sort of the value that we’re providing,” Cook said. “We’re not trying to charge the highest price we could get or anything like that. We’re just trying to price it for what we’re delivering.”

The PR spin here is that the iPhone X isn’t $999 because Apple’s gouging users, but because it provides $999 worth of value. Fair enough. But if Apple thought it could charge $1099 or $1199 for the iPhone X and make more money, wouldn’t it?

Cook also used one of the most tired metaphors for pricing in the technology industry, and I don’t think his heart was in it. He pointed out, quite rightly, that many people will buy the iPhone X on an installment plan with monthly payments, so they won’t see a $999 bill at all. Then, citing a $33/month charge on U.S. carriers, he said, “That’s a few coffees a week—it’s less than a coffee a day, you know, at one of these nice coffee places.”

So wait, people can afford the iPhone X if they stop drinking coffee? Tim, blink if you’re being held against your will in a Blue Bottle Coffee.

iPad: All systems go?

It was the second good quarter in a row for the iPad, previously doomed but now apparently flourishing. Average selling prices took a big bump, suggesting a stronger quarter for the iPad Pro. According to Apple, the iPad grew in all of Apple’s geographic segments, and showed especially strong growth in emerging markets.

Mac: Best year ever

The Mac showed plenty of good signs. 2017 was the best fiscal year for the Mac product line ever by total revenue—$25.8 billion—and this quarter was the best fourth fiscal quarter for the Mac ever. In mainland China, Apple said that this quarter it sold more Macs than ever before.

The average selling price of a Mac ticked up a little bit, too, and Apple suggested that the improved Mac sales this quarter were largely on the back of the MacBook Pro.

Apple Watch and wearables: Growing!

Apple’s just not going to tell you how many Apple Watches it’s sold, but Cook did say that the Watch saw “unit growth of over 50 percent for the third consecutive quarter.” Presumably that’s year-over-year unit growth? Cook also said that the overall wearables category—so throw AirPods in there too—was up 75 percent year over year.

Services can’t be stopped

It was an all-time high for Apple’s Services line, which includes Apple Music, the App Store, and iCloud. Even leaving aside a one-time revenue adjustment, the Services category is growing rapidly for Apple. Last year Apple said it wanted to take its $24 billion in Services revenue for fiscal 2016 and double it by 2020. 2017’s total Services revenue was $30 billion, so it’s well on its way.

Maestri pointed out that Apple’s music business has “turned the corner.” iTunes a la carte sales were declining, but now growth in Apple Music has offset those declines, and Apple’s music business is growing again, which helps contribute to the growth of the Services line as a whole.

Tim Cook thinks AR keeps us human

Cook was asked about augmented reality at a few points during the call, and he gave a description of how he feels AR is a much more humane innovation than many others that was interesting enough that I just wanted to quote it here:

“The reason I’m so excited about AR is my view that it amplifies human performance instead of isolate humans,” he said. “And so as you know it’s the mix of the of the virtual and the physical world, so it should be a help for humanity, not an isolation kind of thing for humanity.”

There you have it. Augmented reality: Good for humans. Virtual reality: Not so much.

Get ready for a blow-out holiday

Wall Street will be over the moon about Apple’s guidance for next quarter. Holiday quarters are always Apple’s best by a wide margin, but Apple’s guidance for this holiday quarter beat all analyst expectations and suggests that the company will set records.

The guidance is for between $84 and $87 billion, which would be between $5.6B and $8.6B more than last year’s holiday quarter, which is the current record. It would be the biggest increase in holiday-quarter revenue since the staggering $17B jump between calendar 2013 and 2014. If the guidance holds, the calendar 2017 holiday quarter would join the past three holiday quarters as Apple’s four biggest quarters of all time.

I guess the holiday party at Apple Park will be epic this year.

Bonus: more charts!

If you appreciate articles like this one, support us by becoming a Six Colors subscriber. Subscribers get access to an exclusive podcast, members-only stories, and a special community.